allowing for cross-ocean sending, albeit in only these two countries. On the other hand, Cash App has started in the U.S. FAQs What is Venmo Venmo is a payments app that lets you send money anywhere you need it to go. and users can only send funds to other Venmo users in the U.S. If you wish to use them on the PC, you’ll need a mobile system emulator. Their UIs are specifically designed for a mobile interface, and they have ceased support for traditional web platforms.

DOES VENMO CHARGE A FEE FOR CREDIT CARD ANDROID

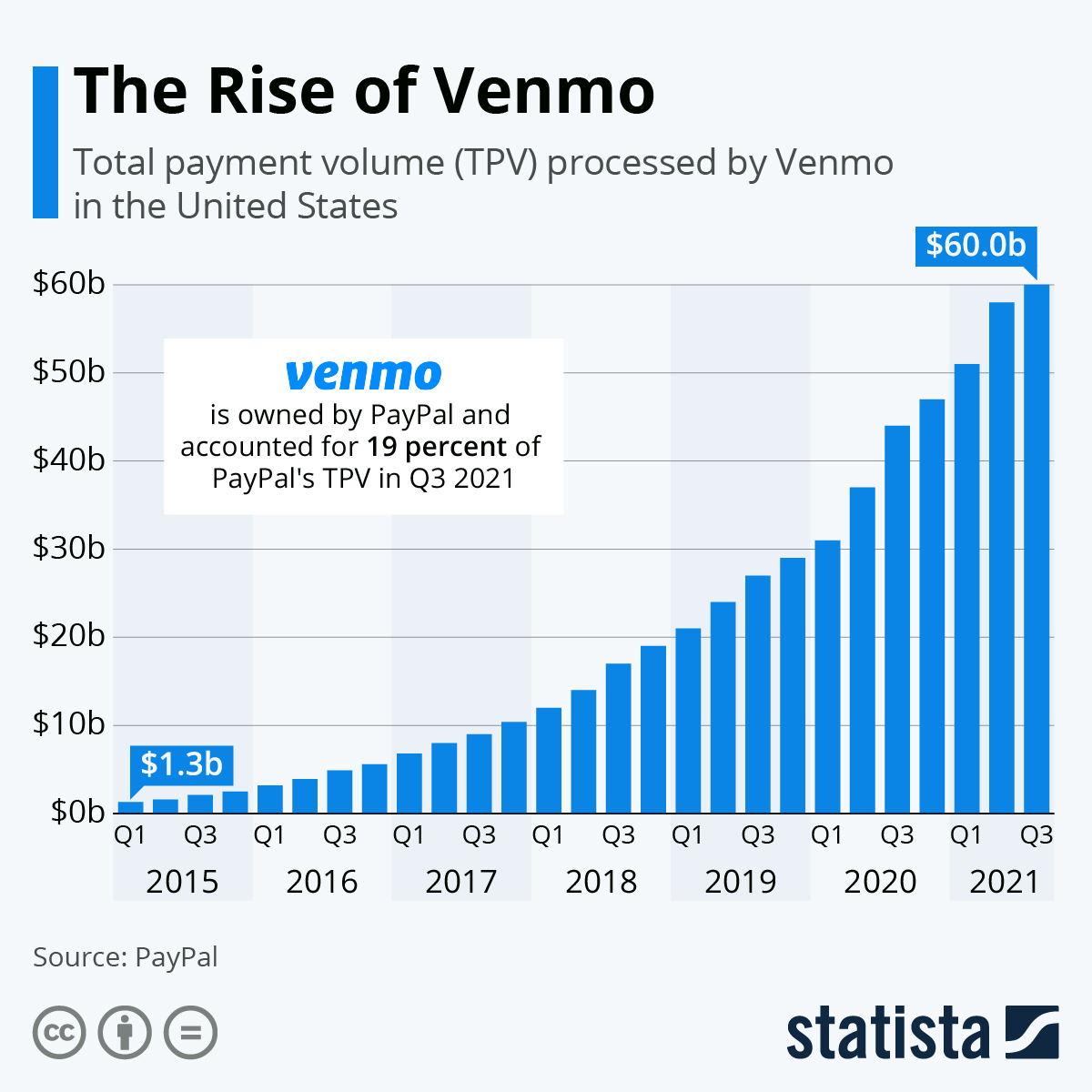

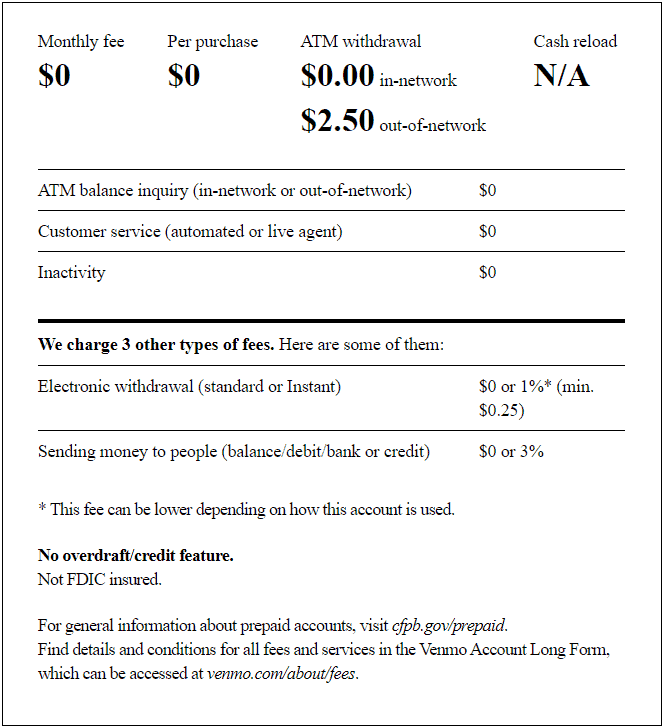

Platformsīoth Cash App and Venmo run on Android and iOS devices. On the other hand, Venmo can accept deposits via check, though faster transfer rates are subject to higher fees. you can always try to open a chase credit card and get a sign up bonus from that instead/as well as the CITI card deleted 1 yr. Cash App has the additional benefit of being able to transact via Apple Pay and Google Pay. Low transaction fee (1.9 + 0. it also varies a bit from bank to bank, i know a lot of the big banks do typically consider Venmo to be a cash advance, but chase bank for example does not. Funding Methodsīoth apps can receive funds via bank transfers, direct deposits, debit cards, and credit cards. Adding money using a physical check Venmo has a convenient feature that allows you to cash checks directly to your account. Cash App has a monthly limit of $10,000, while Venmo has a weekly limit of $4,999.99 to $6,999.99. There is a 3 fee for credit card transfers, though. Verifying your account on either app increases these limits substantially. Unverified Venmo users can transfer up to $299.99 per week. Meet the Venmo Credit Card Earn smarter rewards Automatically earn 3 cash back on eligible purchases in your top spend category, 2 on the next, and 1 on all other eligible purchases.¹ All that, with no annual fee. In response, Venmo has added a way to keep transactions private, though this feature must be turned on manually by users.ĭespite these downsides, Venmo remains a very popular app and is a handy way of quickly transferring money between friends and family.Ĭash App limits unverified users to $250 per week and $1,000 per month. This aspect has been criticized by some as counter-intuitive to the private nature of monetary transactions. Payments made and sent via Venmo can be shown as text messages on its social tab, though amounts aren’t shown. What distinguishes Venmo from other digital wallets is its social networking aspect. As with Cash App, Venmo funds aren’t FDIC insured, but the company is owned by PayPal, and is subject to the same stringent security measures. For payments made using the Venmo app and a QR code, the fee is 1.9. Like Cash App, credit card fund transfers via Venmo are charged with a 3% fee, though any other kind of fund transfer is free. Just like credit cards, Venmo charges a fee every time a business transaction is made. There is also an option for expedited delivery within minutes, with the caveat of higher transfer fees. Depending on your chosen timeframe, your funds can take up to 10 days to appear in your account. Your debit overdraft program enrollment should not affect whether the bank or credit union will allow you to overdraw your account on check or recurring electronic payment transactions, or the overdraft fees you pay when you do.A useful feature of a verified account is the ability to fund it using checks. If you have chosen not to enroll in a debit overdraft program, the bank or credit union will decline ATM or debit card transactions when your account doesn’t have enough funds to cover them, and you will not be charged a fee when this happens. If you do not believe you’ve authorized debit overdraft protection, and the bank or credit union charges you a debit overdraft fee, you may file a complaint. Venmo charges fees for some transactions and transfers. Just notify the bank or credit union that you don’t want debit overdraft coverage. If you are enrolled in a fee-based debit overdraft program, you can change your mind at any time. If you opened a new account since then, you may have signed a document authorizing overdraft protection when you opened the account. If you had an account open as of July 2010, your bank or credit union may have sent you paperwork asking you to opt in to allow overdrafts on debit card transactions and ATM withdrawals.

In addition, declined payments to merchants may trigger a returned item fee from the merchant. However, consumers that decline overdraft coverage for checks or ACH transactions may be charged a non-sufficient funds (NSF) fee from the bank or credit union, which is generally the same amount as an overdraft fee. Some banks may also allow you to opt-out of overdrafts for checks and other types of payments.

0 kommentar(er)

0 kommentar(er)